Sometimes novice collectors get sucked into the low mintage hype. Series like the First Spouse Gold Coin series has produced some of the lowest minted gold coins in the last 100 years. However, just because a coin is “rare” (i.e., low minted), it doesn’t make it valuable.

To better explain this, I will compare a low-minted First Spouse Gold coin and a relatively low-minted Silver American Eagle.

The 2011-W Eliza Johnson First Spouse $10 Gold Coin has an extremely low mintage of just 2,915 coins and contains a half-ounce of pure gold. Even with gold north of $1,300 per ounce, astute collectors can locate this coin in a perfect MS70 for around $1,000. That’s just a modest premium over its melt value.

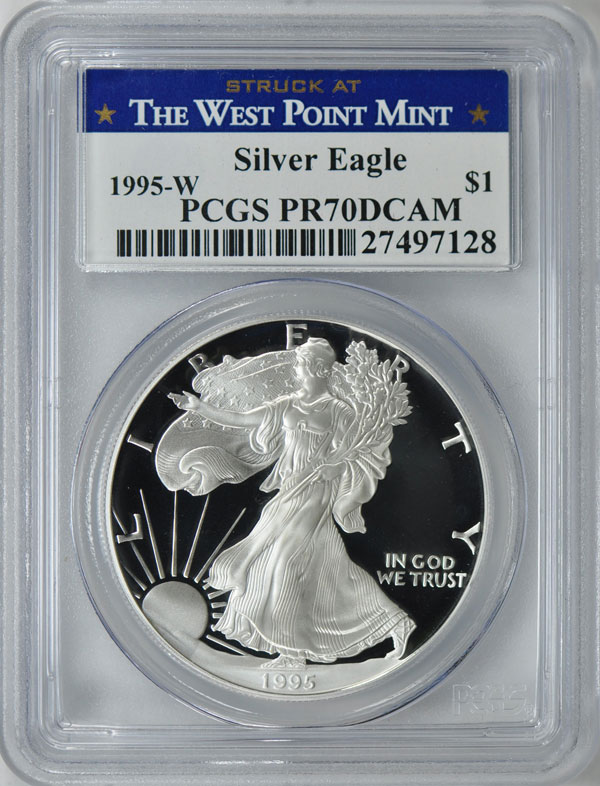

On the other hand, let's look at a 1995-W Silver Eagle Proof. The 1995-W Silver Eagle has an original mintage of 31,000 coins and contains just one-ounce of pure silver. In flawless PR70 grade, 1995-W Silver Eagles can fetch close to $20,000, and a PCGS example has sold for as high as $90,000.

Why such a dramatic difference in price even though the First Spouse coin is over ten-times rarer by mintage? Simple, demand for the Silver Eagle series is much greater than the demand for the First Spouse series. Silver American Eagles have an enormous collector base in the U.S. and abroad whereas the First Spouse Gold Coins seem to fail to connect to people.

When it comes to acquiring coins for your set, it's best to look for coins that are and will be in great demand. These types of coins typically hold their value better and appreciate faster than other coins that are not as popular. Coins like the American Eagles, Morgan Silver Dollars, $10 Gold Liberties, and $20 Gold Liberties are wildly popular coins that have huge collector bases. When trying to decide what to collect, take into consideration whether or not that series has a large enough collector base to support the market.