Platinum is a rare metal, 30 times rarer than gold and yet it is still the third most traded precious metal in the world.

Historically, gold trades at around 80% of platinum prices but in today's market platinum is trading for less than gold. This is a tremendous buying opportunity as history tells us that it won't stay that way for long. But it's not just history telling us platinum prices should trend higher over the next five years, the supply and demand forecast points strongly to higher platinum prices in the years to come.

Platinum demand is expected to increase significantly over the next five years with added demand coming from the medical industry. Yes, I said medical industry.

Most of the demand for platinum comes from the automotive and jewelry sectors which account for about 75% of the annual demand for platinum. As of late platinum has been seeing an increase in demand from the medical sector. Most people are unaware that platinum is used in drugs to treat cancer. Two of the most popular drugs are called cisplatin and carboplatin that treats testicular cancer, ovarian, breast, and lung cancer tumors.

Today, roughly half of all cancer patients receiving chemotherapy are treated with platinum-based cancer-fighting drugs. In 2010, the medical industry used approximately 175,000 oz of platinum, and it is forecasted that the demand could exceed 235,000 ounces in 2019. This would be a 34% increase in demand from just in the medical sector since 2010.

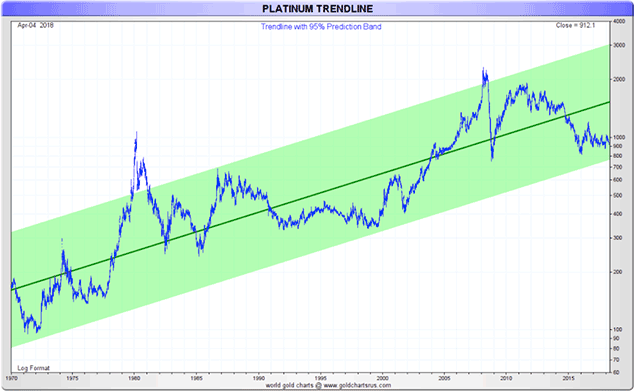

Here is where it starts to get really interesting. The chart below provided by goldchartsus.com, is a chart of platinum prices since 1970. There is a green "prediction" band around the price and as you can see, we are clearly on the lower end of that range.

The last time platinum prices were in this "buy zone" was in the 1990s when platinum was just $350 per ounce. Platinum prices rose by 700% over the next decade.

Now, do I think the price of platinum is going to increase by 700% over the next decade? Although I have read countless articles that have made bold predictions about how platinum could rise as much as 700% in the coming years, I'm not on board that train.

I do however think that platinum is exceptionally undervalued and $1,600 platinum is a real possibility. If platinum were to get back to the $1,600 per ounce level that would be an 83% increase from today's prices, which I think is a little more realistic.

Think about it. Usually, gold trades at about 3/4 the price of platinum. That would mean that at today's gold prices platinum should be trading north of $1,500. So in my opinion, it's clearly undervalued. Couple that with increased demand and falling platinum supplies and it's a very logical conclusion that platinum prices should trend higher over the coming years.

But in reality, I'm a coin guy. And I know if the price of platinum starts to catch up to the price of gold as it should be, this will bring an influx of new collectors into the market. Platinum as a metal is rare, but platinum coins are considerably rarer. Any increase in demand on the coin collector side could cause a tremendous upswing in platinum coin prices, more specifically Platinum Eagle prices as they are the most widely collected platinum coin in the world.

So just how rare are Platinum Eagles? In 2017, the United States Mint struck 228,500 $50 1 oz Gold American Eagles compared to only 20,000 $100 1 oz Platinum American Eagles. This is just one example, but as you can see the majority of the U.S. Mints efforts are put into producing gold coins.

The open market supply for Platinum Eagles is low. Very low. As collector demand rises the only way to entice coins out of these collections is to raise bid prices.

Smart collectors and dealers recognize that now is the time to start acquiring platinum coins. There is a reason why the prominent players, including us, are actively seeking top quality platinum coins and that's because we know prices are at or near the bottom. It's the perfect opportunity to buy.

For the umpteenth time, I'll repeat that many people buy coins today in hopes to sell them in the future at a much higher price. That buyer will probably be an anxious investor who, in a crazed market environment, must have that coin.

We are focusing on low mintage, low populated issues that are hard to find now and will be exponentially harder to find when the market heats up. It's a powerful strategy that has put countless individuals in handsome positions during past platinum bull markets.